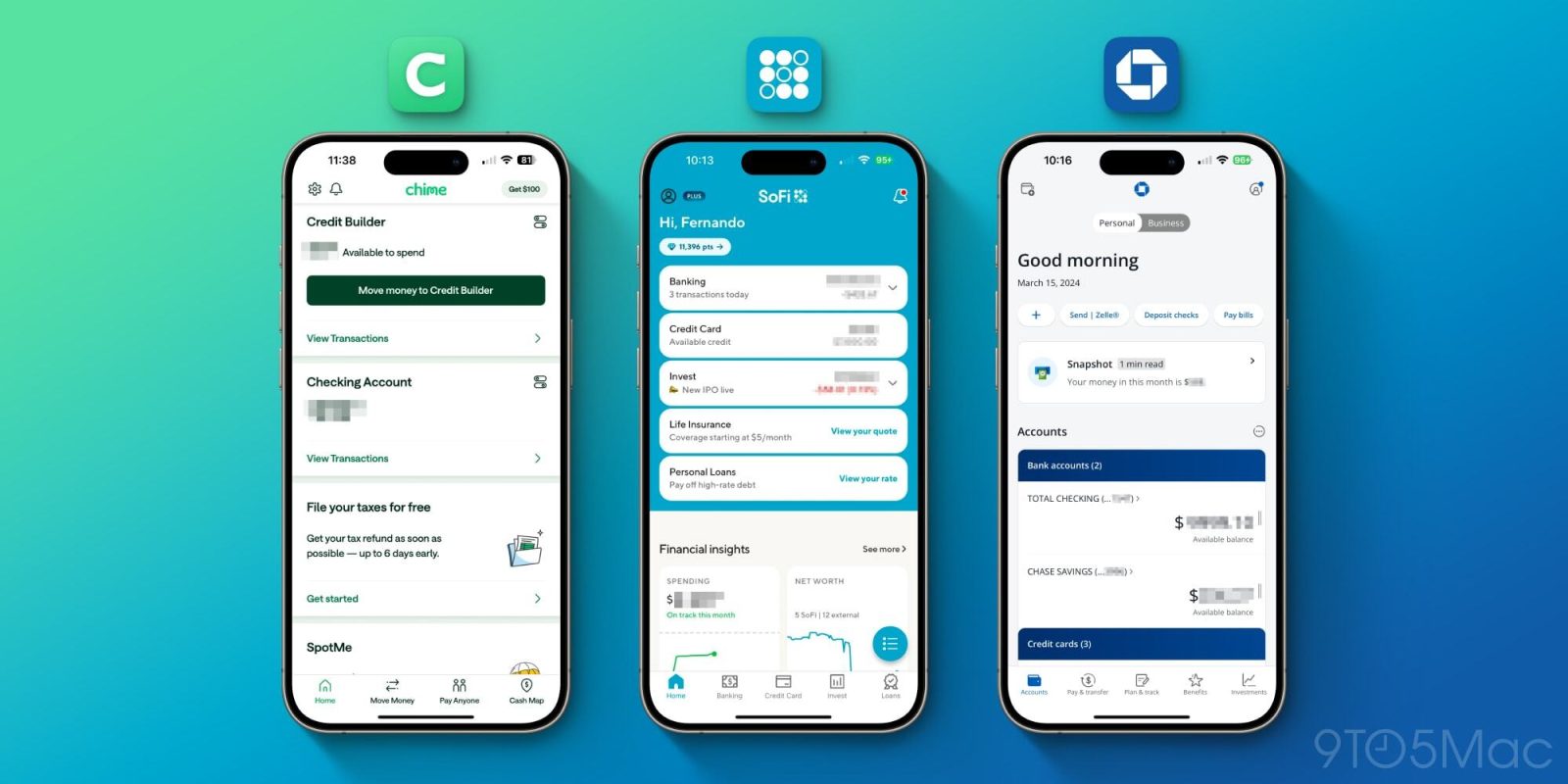

Best modern banking apps on iOS for 2024

In the digital age, banking apps have become our financial lifelines, offering ease and convenience for managing money like never before. Yet, with the constant influx of new Fintech apps, choosing the right one can be overwhelming. Whether you’re opening your first bank account or managing several, our guide to the top three iOS banking apps aims to simplify your choice. Having personally navigated through all three, I’ve found that each serves its purpose. We’ll delve into each app’s features, pricing, and customer service, offering you a clear roadmap to selecting the app that best fits your financial landscape. Let’s uncover the tools that will redefine your banking experience.

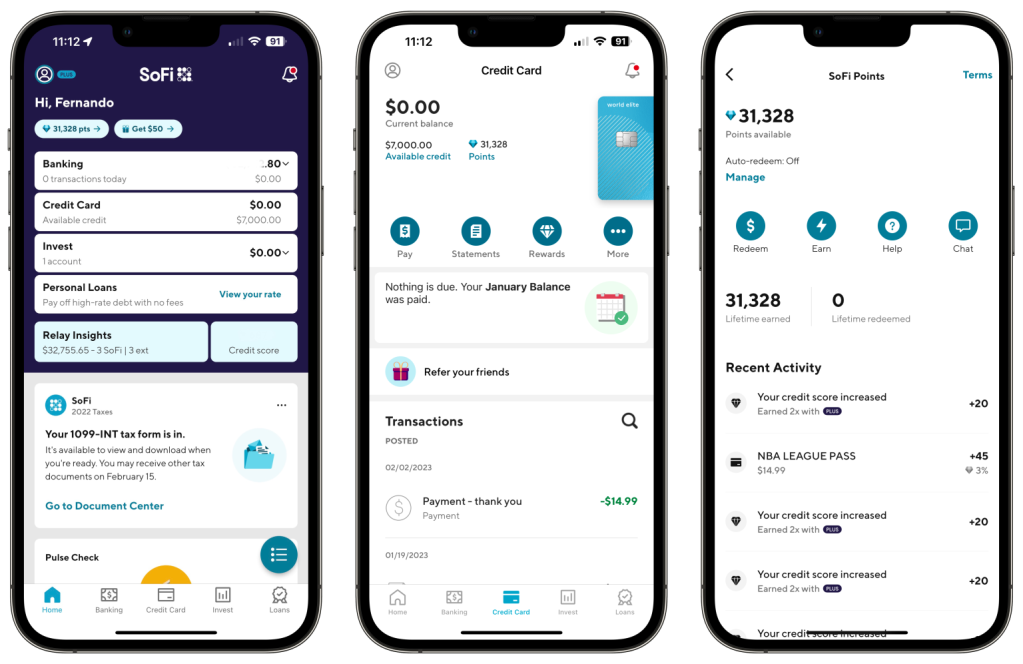

I’ve been with SoFi Bank for over two years, and it’s genuinely improved my approach to managing finances. SoFi stands out by offering an array of services that cater to nearly every aspect of financial planning without the hassle of traditional banking fees, the need for physical branches, and the convenience of getting paid two days early.

One of the key attractions for me has been SoFi’s compelling suite of products. From personal checking accounts with high-yield savings boasting an industry-leading 4.6% APY (As of March 2024), to mortgage loans, Roth IRAs, investment options, credit cards, and even retirement planning, SoFi covers nearly every financial need. Their credit card alone is one of my favorite recommendations, giving you 3% cash back on everything as a zero fee card!

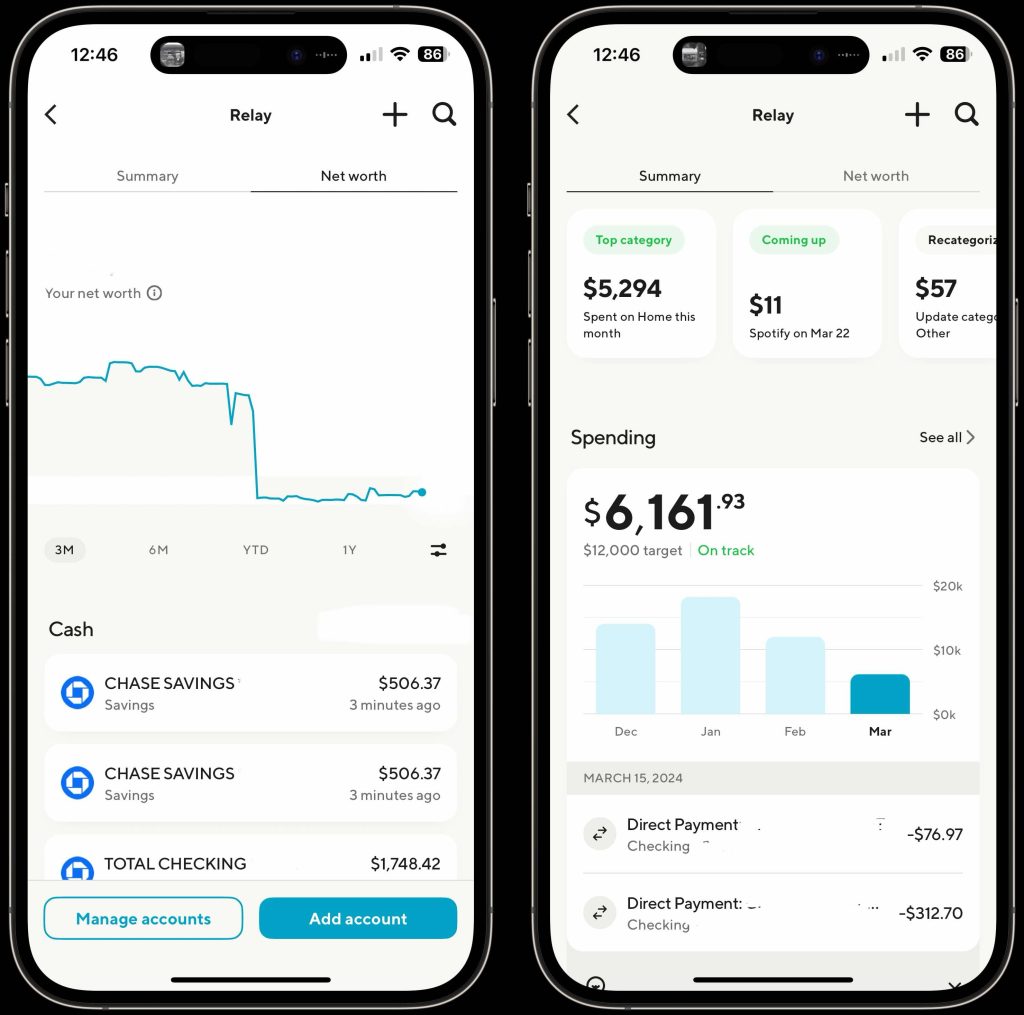

A particularly innovative tool that underscores SoFi’s modern approach is the SoFi Relay product. This feature brilliantly bridges your entire financial landscape, allowing you to link external bank accounts alongside your SoFi accounts. It transforms the app into a central hub for monitoring expenses, income, and even your net worth, all updated in real time. This level of oversight is invaluable for anyone looking to take full control of their financial health.

The user experience of the SoFi app itself is a testament to the bank’s commitment to modernity and convenience. Its design is both aesthetically pleasing and functionally superior, ensuring that navigating through your financial data, whether it’s checking balances, tracking investments, or setting savings goals, is straightforward and hassle-free. The emphasis on a seamless and secure user interface, combined with the comprehensive financial overview provided by SoFi Relay, places SoFi Bank at the forefront of next-generation banking solutions.

Pros

- Feature-rich & easy-to-use interface, 4.8 stars on the app store

- High-yield savings account – 4.6% APY

- Vaults – used to automatically save for certain things

- ZERO fees, no transaction fees, late fees, overdraft fees, or monthly fees of any kind

- Paycheck two days early

- Investing platforms

- Retirement planning

- ATM network of 60,000 ATMs

- Mobile check deposit

- Great, zero-fee, beginner credit card with 3% cash back

- Offering $25 for new Sign Ups

- Free Credit Score

Cons

- No physical bank branches

- No cashier checks

- Depositing cash is possible but not ideal

Who should open a Sofi account?

SoFi is the ideal choice for banking customers eager to elevate their financial management. Its iPhone app combines simplicity with intuitive navigation, offering a wide range of services without the complexity. Ideal for users valuing a top-notch mobile banking experience over physical branches, SoFi provides high-yield savings and access to additional financial products like investing and credit cards. This makes SoFi the perfect platform for anyone looking to seamlessly integrate their banking and financial growth.

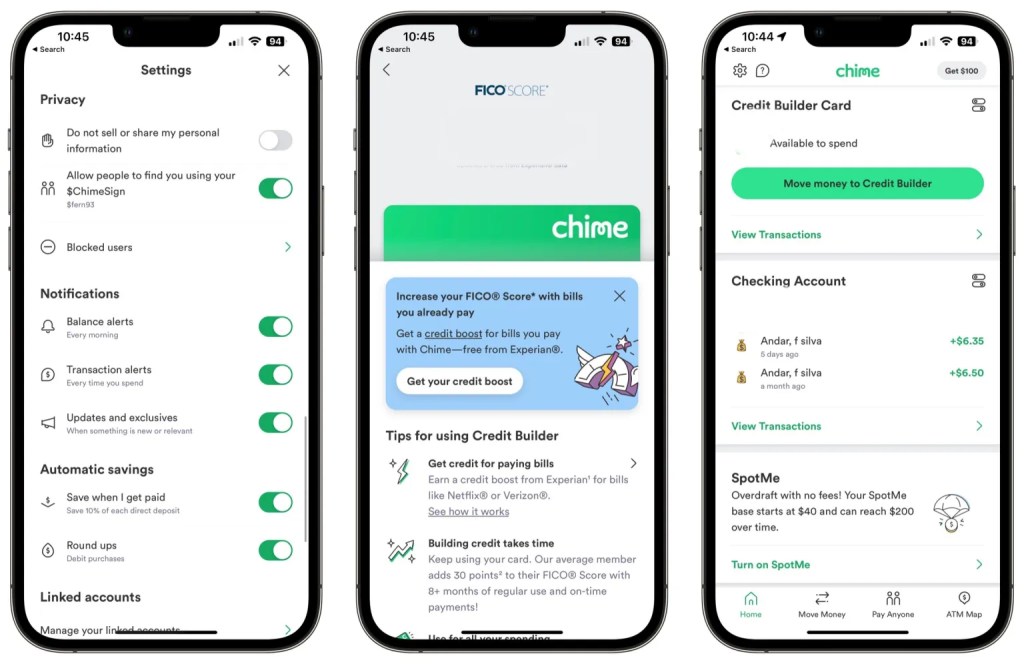

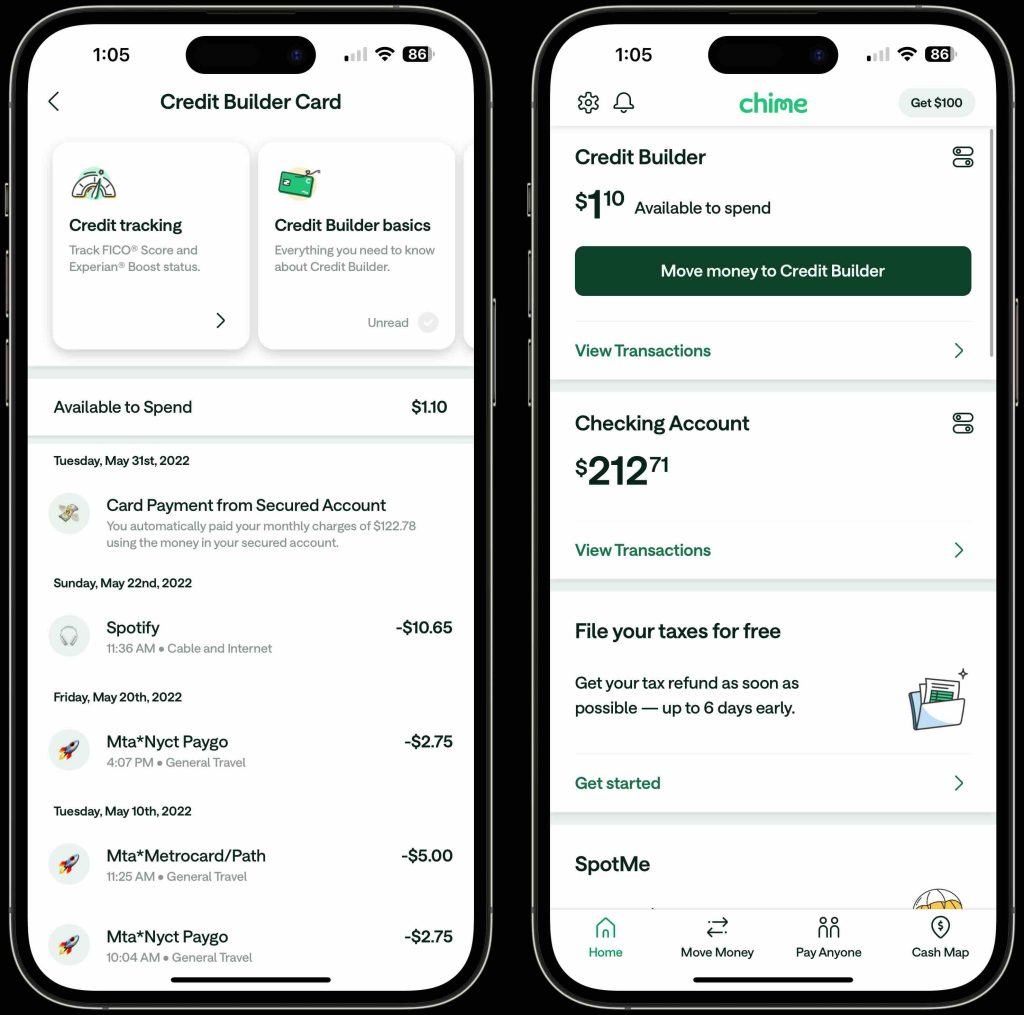

While I’ve moved on from Chime as my go-to bank, it holds a cherished spot in my financial history. I was with Chime for a solid five years before switching to Sofi. Chime was like a crash course in adulting financially—it showed me the ropes on saving for the long haul, building a solid credit score, keeping on top of my bills, and a whole lot more.

Chime is a total no-brainer for beginners. Signing up is a breeze, and you can kiss goodbye to those sneaky hidden fees. The app is super user-friendly, making it a piece of cake to keep your finances in check. But the real game changer? Chime’s credit builder card. It’s a genius way to boost your credit without drowning in debt, thanks to a prepaid system that ensures you’re always on time with payments. This credit builder feature increased my credit score immensely over the 2 years I had their Credit Builder card. Plus, with a ton of free ATMs in their network, you won’t be forking out extra cash on fees.

Pros

- Extremely user-friendly, 4.8 stars on app store

- Chime Credit Builder program – free credit card to help build your credit

- Get paid two days early

- ZERO fees, no transaction fees, late fees, overdraft fees, or monthly fees of any kind

- Spot Me service for overdraft protection up to $200

- Automated savings feature – Round up savings and automated paycheck division

- Disable lost or stolen card

- View card info digitally

- Mobile check deposit

- Free Credit Score

Cons

- No physical branches – if you are someone who likes to go into a bank, then this is not for you

- Mobile check deposit is only available if enrolled in direct deposit

- Not very product-rich. No investment platform, loan products, insurance platform, or mortgage offerings

- No cashier checks

Who Chime is for?

I jumped on the Chime bandwagon initially because I was all about that slick user experience and their trailblazing approach to banking without those pesky fees or the need for a physical bank I’d never visit. What I was after was something solid I could run entirely from my phone, where I could get my paycheck dropped straight in. As Chime upped its game, I got hooked on their Credit Builder, which pumped my credit score up by a sweet 45 points in just a year by proving I could pay on time, every time.

This is a golden ticket for anyone fresh into the job market who needs a bank that’s easy to navigate, gives a leg up in building credit, and lays down the basics of saving without making your head spin. Also, they’re throwing $100 your way if you sign up and set up your direct deposit.

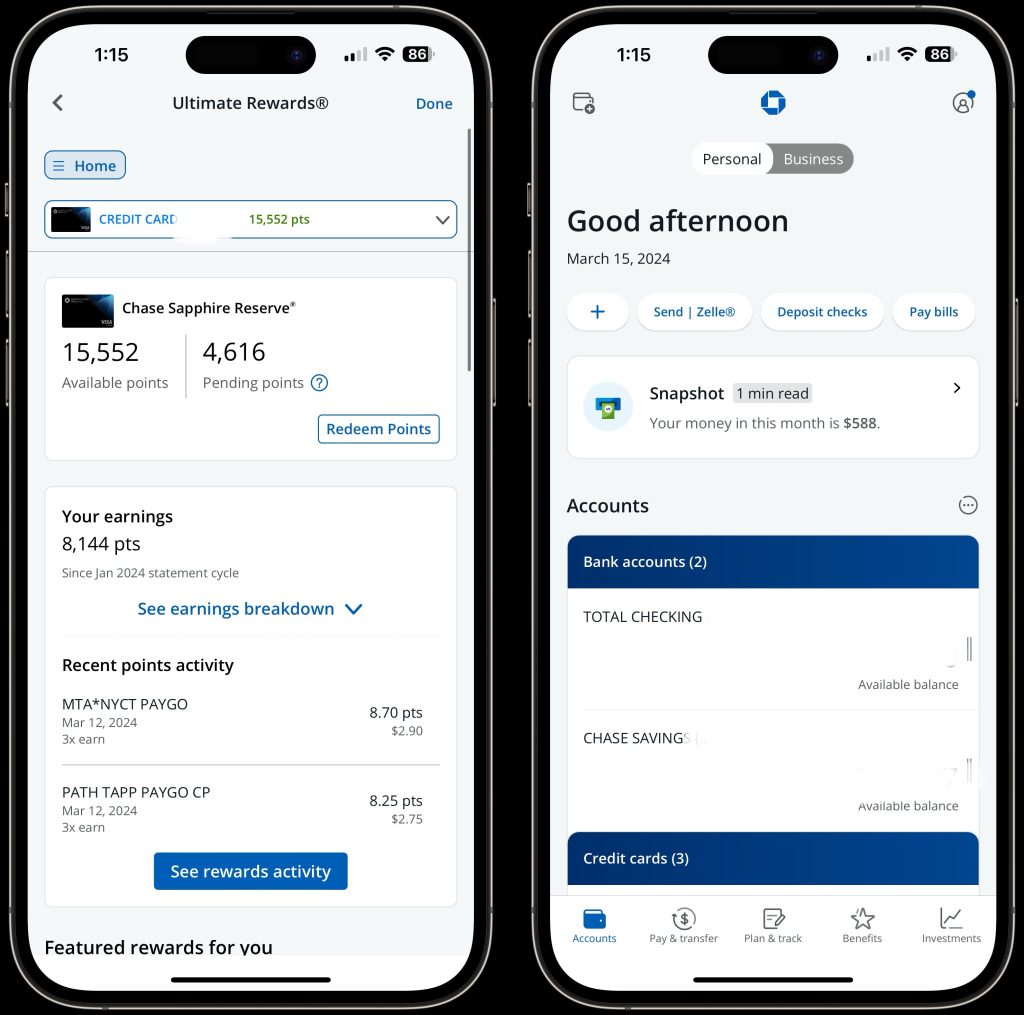

Chase Bank is the go-to for those who want the reliability of traditional banking with the convenience of a cutting-edge iOS app. It perfectly blends the comfort of physical branches with digital innovation, ensuring a seamless banking experience for all customers. The app itself is a powerhouse, offering easy account management, remote check deposits, and personalized alerts. This digital tool simplifies your financial life, making it easy to stay on top of your money with just a few taps.

Moreover, Chase doesn’t stop at digital convenience—it’s a comprehensive financial hub. From mortgages and auto loans to student loans, Chase offers every financial product you might need, making it incredibly convenient to manage all your financial affairs in one place.

The cherry on top is the Chase Ultimate Rewards program, which I have become obsessed with. I have been able to book business class travel from US to Europe for free. It turns everyday spending into points that can be redeemed for luxury travel, offering a world of free, high-end travel experiences. Here is the card I use for that!

Choosing Chase Bank means opting for a banking experience that combines tradition with technology and convenience with comprehensive financial services, all while unlocking the potential for luxurious travel through smart spending.

Pros

- 4.8 stars on app store

- Huge array of product offerings

- Extensive physical branch network

- Chase Ultimate Rewards program

- Huge list of credit card options to apply for

- Credit score tool

- mobile check deposit

- Disable lost or stolen card

- Legacy bank

Cons

- Account minimums

- Not free to open account

- No real HYSA option

- Sometimes too many options

Who is Chase for?

Chase is the ideal pick for anyone who wants the best of both worlds: a slick, highly-rated iOS app for managing money on the fly and the solid backup of traditional bank branches. It’s spot-on for tech lovers, savvy savers, and globe-trotters, offering a wide range of financial services from basic banking to rewarding credit cards. With Chase, you get a banking experience that’s versatile and rewarding, tailored to fit a variety of needs and lifestyles, all while keeping things straightforward and accessible.

Wrap up

It’s clear that you can’t really go wrong with any of these mobile banking options. Chime served me well for years before I transitioned to SoFi, which has brilliantly met my evolving financial needs—be it getting a credit card, planning for retirement, or diving into investment accounts. Switching gears to Chase Bank allowed me to maximize my spending and taught me how to navigate the credit card game responsibly. Each of these platforms streamlines your financial journey, offering incredible value and empowering you to cultivate a positive relationship with your money. Regardless of where you find yourself on the financial spectrum, these apps stand ready to bolster your money management with ease and expertise. Let me know who you bank with and why and lets discuss in the comments below.