The cryptocurrency world watches with a mix of intrigue and apprehension as Tether (USDT), the most prominent stablecoin, inches closer to a seemingly mythical $100 billion market capitalization. This monumental milestone signifies Tether’s undeniable market dominance, but it also casts a spotlight on the regulatory clouds gathering around the stablecoin and the potential implications for the wider crypto landscape.

Tether: A Haven Of Stability In A Stormy Sea

Tether’s success hinges on its core value proposition: stability. Unlike the often-volatile nature of Bitcoin and its peers, Tether is pegged to the US dollar, maintaining a near-constant value of $1. This stability attracts investors seeking a safe harbor in the turbulent crypto market, making it a preferred choice for trading, storing value, and participating in decentralized finance (DeFi) protocols.

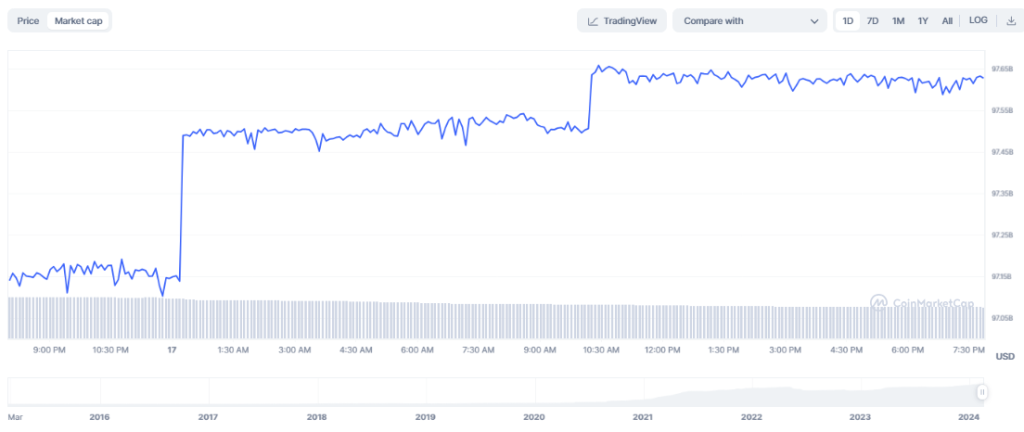

Tether's current market cap. Source: CoinMarketCap

Beyond offering stability, Tether boasts strong financial performance. The company recently reported a whopping $3 billion in profits for the fourth quarter of 2023, with a significant portion stemming from US Treasury interest and gains from rising gold and Bitcoin holdings in its reserves. This robust financial health fuels confidence in Tether’s ability to maintain its peg and meet its obligations.

The Looming Shadow Of Regulation

However, Tether’s path to achieving the $100 billion landmark isn’t paved with roses. Regulatory scrutiny presents a major hurdle. While Tether operates outside the US jurisdiction, its dependence on the US dollar and potential interactions with US entities expose it to potential control from US regulators, particularly through the Office of Foreign Assets Control (OFAC) sanctions. This regulatory uncertainty hangs like a dark cloud over Tether’s future, with some experts questioning its long-term sustainability.

USDTUSD currently trading at $1.00027 on the daily chart: TradingView.com

Beyond Tether: A Broader Stablecoin Landscape

Tether’s impending milestone has broader implications for the entire stablecoin landscape. Its success has triggered a domino effect, leading to a significant surge in the combined market capitalization of other major stablecoins like USDC, DAI, BUSD, and TUSD. This growth signifies the increasing role stablecoins play in the crypto ecosystem, facilitating transactions, providing stability, and enabling innovative DeFi applications.

💸 Since late September, the constant in #crypto has been encouraging rises in #stablecoin market caps. The combined cap of $USDT, $USDC, $DAI, $BUSD, $TUSD, and $USDP is up $9.42B in 4 months, typically a necessary ingredient for #bullish conditions. pic.twitter.com/yYMBc3hsdL

— Santiment (@santimentfeed) January 28, 2024

Meanwhile, senior commodity strategist at Bloomberg, Mike McGlone, emphasized Tether’s dominance in the stablecoin space and its significance for the larger financial sector.

In a post on X, McGlone pointed out that Tether’s expanding market capitalization might be a sign of the dollar’s growing sway, which might have consequences for traditional assets like gold and commodities.

A $100 Billion #Tether? #Bitcoin vs. #Gold, #Dollar vs. #Commodities – The proliferation of #stablecoins could portend increasing dollar dominance, with headwind implications for commodities and old analog gold vs. the digital version. What I call crypto dollars, Tether is the… pic.twitter.com/6mWTIfLfGg

— Mike McGlone (@mikemcglone11) February 16, 2024

The Crossroads For Tether And The Stablecoin Revolution

As Tether stands on the cusp of a historic achievement, its future trajectory remains uncertain. While its stability, financial performance, and role in DeFi are undeniable strengths, the regulatory shadows and concentration risk pose significant challenges.

Whether Tether can navigate these hurdles and reach the $100 billion summit, and what its success or failure means for the broader stablecoin revolution, are questions that the crypto world eagerly awaits answers to.

Featured image from Adobe Stock, chart from TradingView